If you entered into a home loan before 23 October 2018 and haven’t been advised that your loan is moving to one of the above interest rate types, see applicable rates here. An establishment fee of up to $150 may apply.Ī Residential Owner Occupied rate or Residential Investor rate will apply. Some interest rates may require you to have a certain minimum equity in the property used as security, and for some rates a low equity interest rate premium rate may apply if you have a low loan to value ratio. Borrowers can contact their servicer to discuss whether this is an appropriate solution for their unique circumstances.Things you should know about our home loans and this calculatorĪll home loans are subject to our lending criteria (including minimum equity requirements), terms and fees. Payment deferral will help borrowers keep the same monthly mortgage payment by moving past-due amounts to the end of the loan as a non-interest bearing balance, due and payable at maturity, sale, refinance, or payoff.

CALCULATE HOUSE PAYMENT MAC

Update: The Federal Housing Finance Agency (FHFA) has announced on 2 that Fannie Mae and Freddie Mac will allow borrowers facing financial hardship to defer up to six months of mortgage payments.

buy decision.īest wishes for an affordable home mortgage loan and a great new home! You should consider all these factors, especially when making a rent vs. Some expenses (e.g., property taxes, homeowner's insurance etc.) will continue even after you have paid off your loan. If you opt for ARMs, your mortgage interest rates (and monthly payment) will change over time. Some of the recurring expenses will change over the lifetime of home ownership due to home value changes, inflation and other factors.

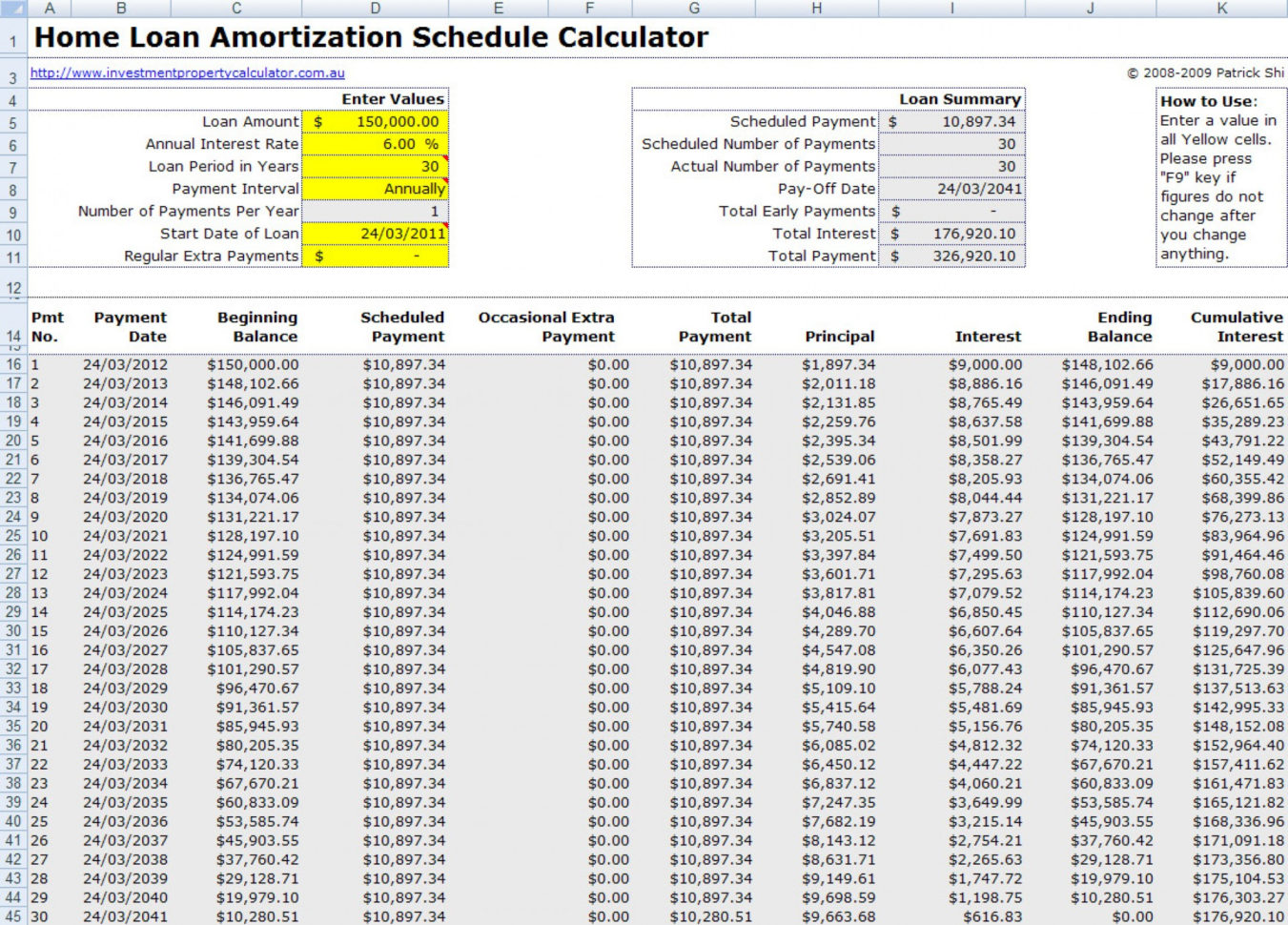

If you are refinancing your loan, you should treat the down payment amount as the equity you own in your home. The difference between home value and the mortgage amount is considered your down payment.Here are a few important points to help you understand the mortgage calculations: A table showing the difference in payments, total interest paid and amortization period under both schemes is also displayed. Many homeowners wish to accelerate their mortgage schedule through extra payments or accelerated bi-weekly payments. You are presented with a detailed mortgage payment schedule. It also calculates the sum total of all payments including one-time down payment, total PITI amount and total HOA fees during the entire amortization period.

CALCULATE HOUSE PAYMENT FREE

This free mortgage calculator helps you estimate your monthly payment with the principal and interest components, property taxes, PMI, homeowner’s insurance and HOA fees.

0 kommentar(er)

0 kommentar(er)